Extended TV Interview with U.S. Senator Sherrod Brown on Trade, Jobs, Great Lakes, more

Ohio’s Democratic U.S. Senator Sherrod Brown spent much of today (March 20, 2017) in Cleveland, for events touching, in part on infrastructure investment, and job creation.

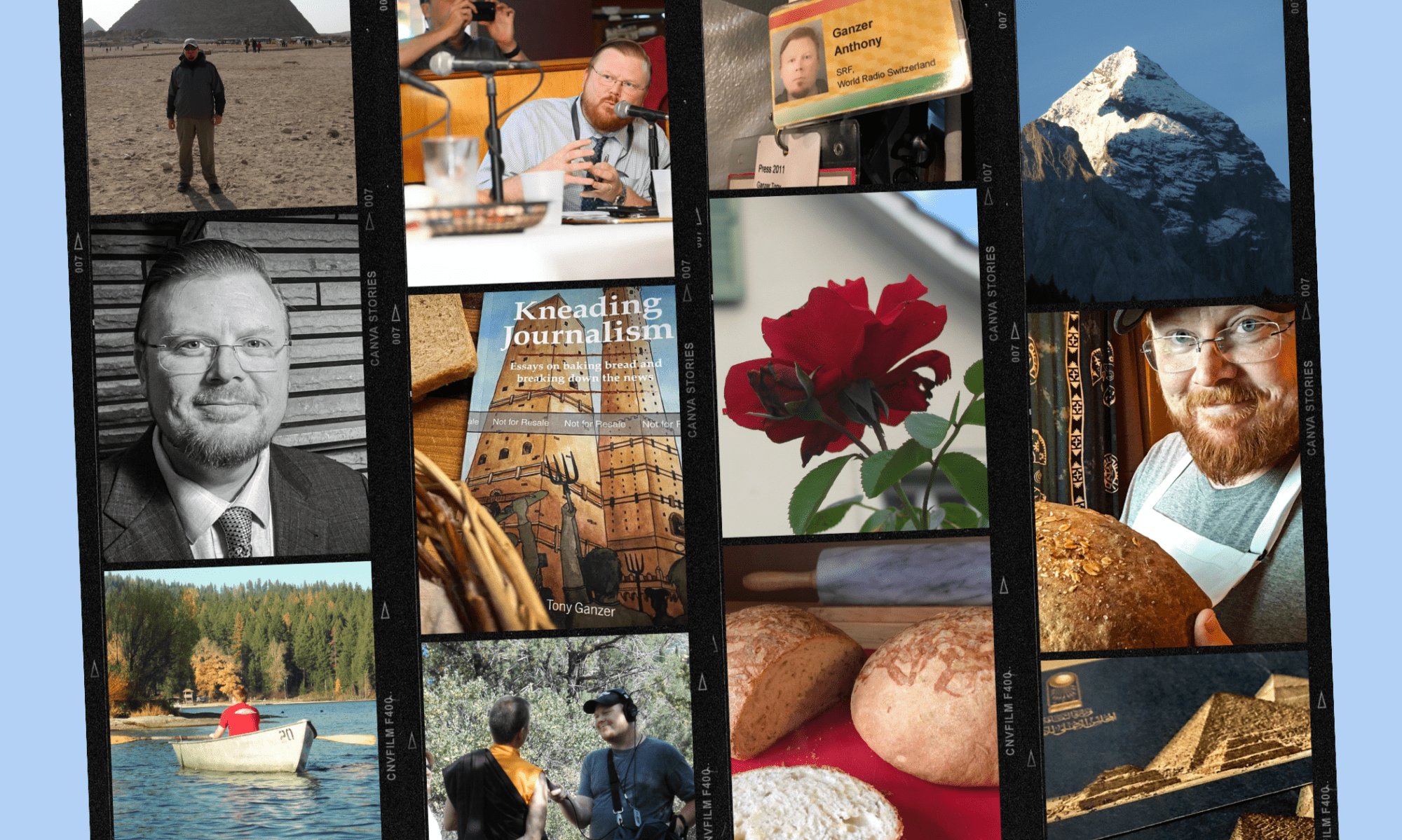

ideastream’s Tony Ganzer spoke with Brown about a number of issues, including proposed cuts to the Great Lakes Restoration Initiative, renegotiating trade deals like NAFTA, his thoughts on job and career-creation, and his thoughts on President Trump, among others.

[iframe width=”640″ height=”360″ src=”https://www.youtube.com/embed/Qhr9tZIQCHM” frameborder=”0″ allowfullscreen]

Listen to a radio report and find a partial transcript from WCPN:

TV excerpt aired March 20, 2017 on WVIZ’s Ideas program. A radio excerpt aired the same day on WCPN’s All Things Considered.

BROWN: “A trade war is unacceptable, and I would hope the President doesn’t want to see a trade war. I certainly have never, my position on trade has never gone to that. But I think the whole idea of renegotiation suggests that both sides come to the table, and you renegotiate issues like the rules of origin for auto, which would matter for our auto industry, not just Ford, and GM, and Chrysler, and Honda in Ohio, but the whole supply chain. You also talk about investor-state dispute settlement, where corporations have the power to sue other countries on trade that really does ultimately undermine consumer protections, environmental rules, and all that. So those are the ones we need renegotiation. Two days after the election, literally, I called the President’s, I called the leader of his transition team on trade, and talked to him at length about my offer to help him renegotiate NAFTA, to pull out of Trans-Pacific Partnership, and to be aggressive about trade enforcement rules. That sometimes makes other countries unhappy. They enforce their rules aggressively, we should, too. That doesn’t mean trade war, it means a leveler playing field, and it means you follow the rule of law. We haven’t done that as well as we should. I’m hopeful, and I will stand with this president to do that. I’ve not seen anything come out of that yet, I hopeful it does.”

Down Economies and Airports

The airline industry earlier this week was beaming, as a new survey gave it its highest customer service numbers in 4 years. But with the economy still struggling to make a comeback, airports may need to readjust their plans as demand and dollars are dipping. KJZZ’s Tony Ganzer reports.

Continue reading “Down Economies and Airports”U.S. bank clients casualties in an ‘economic war’?

When the CEO of Switzerland’s biggest bank calls tax disputes with the United States and other nations “an economic war” people take notice. UBS CEO Sergio Ermotti said that last month, as Switzerland faces a still contentious relationship with its neighbors and the U.S. hunting for untaxed assets hidden in the alpine confederation. The U.S. is the world’s only super-power, and has not shied from using its economic and diplomatic might to seek and reclaim back taxes, and punish banks who helped hide the money. But in any war, even an economic one, there are casualties. And the changes Swiss banks have made in response to the U.S. have made things for some Americans in Switzerland much more difficult.

Katherine moved to Switzerland from Ohio in 2008 to be an Au Pair. The US was in the middle of its financial crisis and she figured “why not?” First order of business in Zurich was to get a bank account.

“I had gone to I think it was UBS the first time, and they had said that they didn’t offer any bank accounts to Americans who had less than $250,000,” she said. “My boyfriend, at the time, and I just laughed at that, like, ‘she has to have a bank account. She’s going to be living here.’”

Katherine was ultimately granted a young person’s account at UBS. Now, years later, the graphic designer and her husband are having account troubles again, trying to get a mortgage.

“We got so far along in the mortgage process that people were telling us it was a good time to buy, and then it was only literally right before we were going to sign the contract that we were finding out, ‘Wait a minute, she’s American, this is a red flag, this is a problem.’” …